From our childhood, we are taught to study hard, get some skills, get a stable job and earn a steady income – and that’s pretty much about it. Oh yes! We also get told to get married, raise children and all. Most of the time from our family, from our school no one teaches us the life’s most important skills: such managing budget and finances, managing investment, planning with cash flow, planning retirement etc. but they have a profound impact on the family, old-age and our life in general. In this article, I will show you the difference between cash flow and assets (also known as wealth) and tell you why & how you should be focusing more on the asset that your cash flow.

Cash flow vs Asset (Wealth) – what are the difference?

In simplest term, cash flow is the total income that is coming into your account on a periodic basis (i.e. weekly, fortnightly or monthly). Income could be from various sources i.e. your job, rental income from your property etc. From this money you get you would have a lot of expenses, for example: paying rent/mortgage, buying food and grocery, children education and activities, clothing’s, tax and the list goes on and on and on. Hopefully end of all you would have some money left in the account and that goes into your savings which are, in turn, become your wealth for a longer term.

Your wealth is leftover of all your tangible asset after taking away all your liabilities. In here, tangible assets are things like: cash in bank the (or cash under your pillow), current value of properties you have, resell value of the jewellery etc. & liabilities are for example credit card liability, home loan, personal loan, money you owe to other people. Bigger the number in ‘leftover bucket’. by theory richer you are – simple! Even simpler way to think about is: if today you stop working and sell everything you have in your possession for cash and from that money, you pay everyone you owe – whatever leftover in your account is your asset.

Focus on creating wealth

As you might notice already that, even though cash flow has some impact on your wealth it is not the only side of the equation. In simple terms:

Your wealth/asset = (Your total income – Your total expenses) * Accumulated over years

If you earn a lot and then spend a lot you have nothing for your asset. Then again if you spend less but you have relatively small income then also you don’t create any asset. Key to find the balance and have some leftover for your asset.

Why asset is important

No one work throughout their whole life. Average life expectancy in Australia is 82.25 years while most people retire around 65 year. Have you ever wondered how you will live on for 20 years towards the end of your life? Some people think at that time your expenses will be lot lowered as you don’t have to take care of the kids, pay their tuition fees etc. but think again – is it? You will have more medical bills, you will have your grandchild’s expects gifts (and you will have more of those than your children’s) from you, you will have a lot of time in hand to travel, with CPI increase the item you get for $10 today you will be easily paying $13-$15 in 10 years’ time. I think as you grow older you will need more money.

Now let’s look at some numbers: if you are earning 100K per year to generate the same amount you would need 1.25million worth of asset and generate 8% return on that asset to have 100k per year. Please note your residential property doesn’t count provided you will live in there. Furthermore 8% income is a very high rate provided cash rate for most the bank is only around 3-4%.

Bottom line is your income will die down as you grow older but your expenses and need won’t – and your assets if the only thing will stay with you till you die.

Cash is the laziest form of asset – make it work hard for you

With all the savings you have, do not just keep accumulating them cash. Cash is the laziest form of the asset you can have. On an average cash gives your around 2-3% return compare to the least risky form of asset like property gives you average of 6+% and stock market give your around 10+%. More aggressive form for managed fund or investing in a company (or having your own) will give you 8% – 20%. In general the way it works is, riskier the investment is, higher the return it likely to give you. Key is to know which life stage you are in, what is your risk appetite, how much fund you have etc. all these will contribute to the decision on how you should distribute your asset. Regardless, my personal opinion is, you should never have more than your three months’ of your salary available to you as cash, if you have that is such a waste of your investment opportunity and surely you will regret later, especially when you are a bit older!

Create your personal wealth dashboard

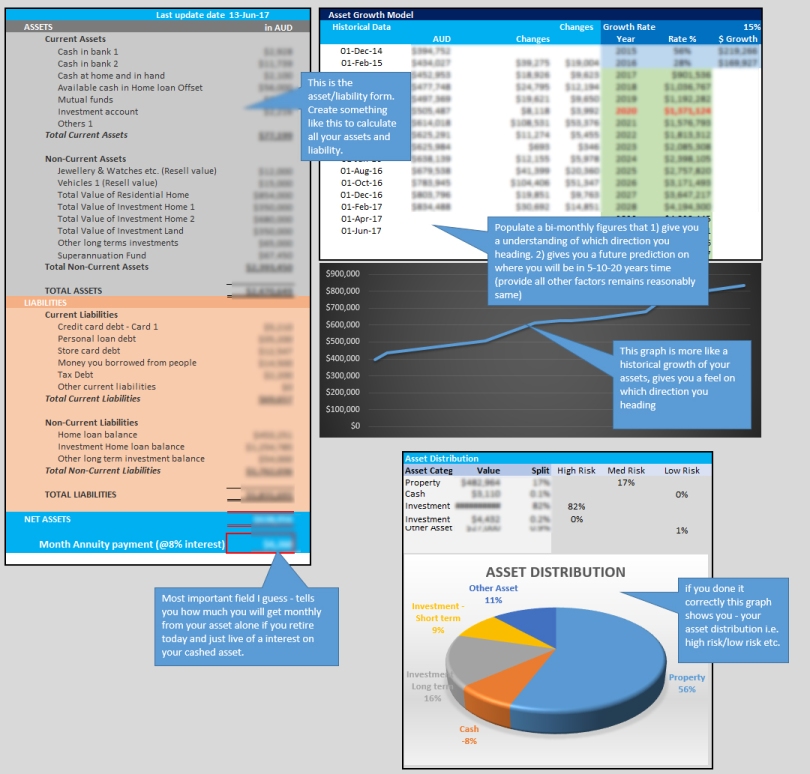

Now all that is fine, but how do you calculate your wealth. This is not something new, all the Now all that is fine, but how do you calculate your wealth. This is not something new, all the companies create a balance-sheet to so show how they are performing. Most of the accounting principles are there to calculate companies’ balance sheet. I have created a similar dashboard that a lot of companies use, that might help you to create your own personal wealth/asset balance-sheet below with the fundamentals accounting and book-keeping principles:

A couple of key notes:

- Be honest with yourself when you filling this up i.e. don’t just inflate your asset value etc. end of the day this if for your not anyone else – by inflating who you showing off!!

- Do it around the same time of the month. Reason I say that is normally around different time of the month you would have a different cash distribution

- Do it regularly (once every two-three month) – this will give you a realistic picture of your asset, their growth and most important some future perdition that will tell your if you are heading to the right direction for your retirement fund i.e. will you going to have enough.

- Graph and number tell you nothing unless you want to understand and you take some corrective action out of it.

Finally – what do you do with this dashboard? you monitor, you know how much you worth and how much you need more to retire, use this as your wealth tracking mechanism and motivation to save but most importantly invest.

About the author: My name is Shahnewaz Khan (tamal_khan@hotmail.com) I am a Project manager at my day-job and have done fair bit study from post-grad Business school. I find there are a lot of principles from my day jobs and the things I learned at B-School can be applied to our daily life. In my blog I write about those – please subscribe if you like for regular updates.

One comment